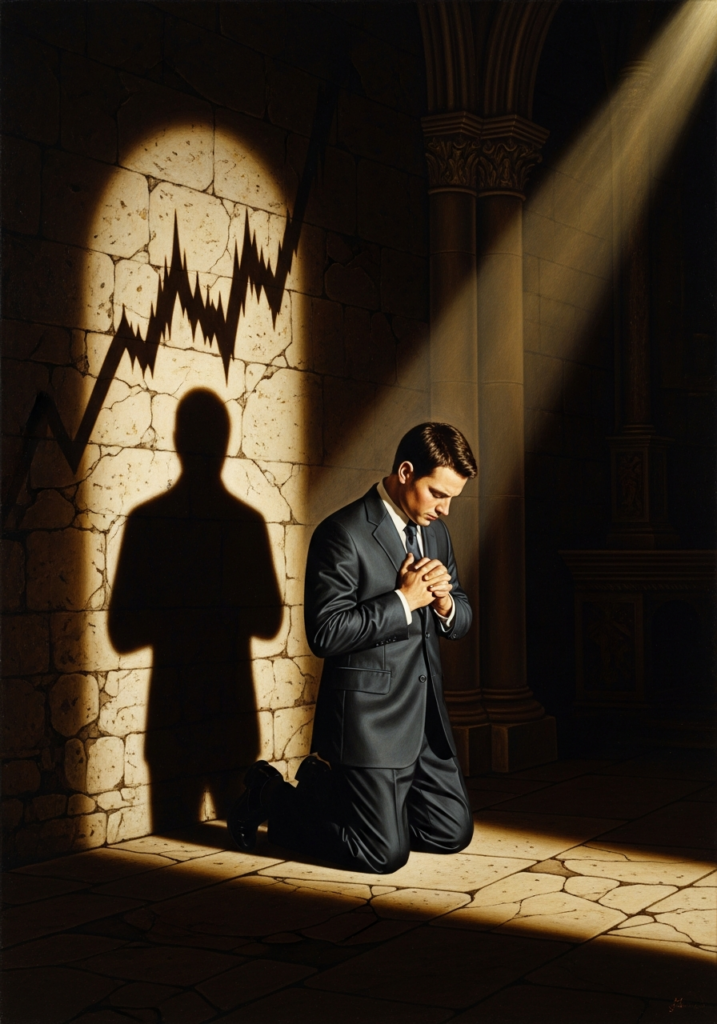

There exists a silent heresy in the pews of the modern church, one not spoken in creeds but practiced in ledgers. It is the heresy of compartmentalization, the unspoken belief that the moral laws governing the sanctuary on Sunday morning are suspended by the laws of economics on Monday morning. We have accepted a bifurcation of the soul that would have horrified the ancients, creating a distinct species of the modern believer: the Schizophrenic Investor.

This investor is a man who professes the Nicene Creed with fervor, who defends the sanctity of life and the dignity of the family in the public square, yet who retreats into the private glow of his brokerage account to profit from the very forces dismantling the civilization he loves. He asks, “Who am I when no one is looking?” But the more terrifying question for the modern age is: “Who are you when you open your trading app?” If the answer is a ruthless pragmatist who believes that money is neutral and that yield absolves all structural sins, then you have not merely made a moral error. You have made a mathematical one. You have introduced a fracture into the foundation of your wealth.

To understand why this is a financial disaster and not merely a spiritual failing, we must recover the true definition of that overused and under-examined word: Integrity. In our secular lexicon, integrity is reduced to simple honesty, such as telling the truth or not stealing. But in the Aristotelian-Thomistic tradition, integritas implies something far more robust. It means wholeness, completeness, the state of being an “integer” rather than a fraction. It is the structural soundness of a thing that allows it to stand.

Here we find the deep connection to the term “Catholic.” Derived from the Greek kata-holos, meaning “according to the whole,” to be Catholic is to view reality in its totality. To accept the universe not as a chaotic collection of disparate atoms, but as an ordered cosmos where every part relates to the Final End. Therefore, a portfolio that is compartmentalized, cut off from the moral law, is not “neutral.” It is by definition defective. It lacks wholeness. It is not kata-holos. It is a disintegrated entity, holding within it the seeds of its own dissolution.

The modern financial advisor, trained in the utilitarian schools of post-Enlightenment thought, will tell you that ethics is a drag on performance. He will speak of the “sin stock premium,” arguing that companies peddling vice yield higher returns because they are undervalued by the squeamish. This is a profound metaphysical error. It relies on a misunderstanding of the relationship between Being and Action.

The scholastic axiom agere sequitur esse, action follows being, is the governing dynamic of the universe. A thing acts according to what it is. If a corporation’s “being” is rooted in the exploitation of human weakness, the destruction of the family, or the negation of life, its “actions” (its cash flows, its growth, its longevity) are essentially parasitic. They are not generating value. They are extracting it.

This brings us to the metaphysics of value. St. Augustine and St. Thomas Aquinas taught us that evil is not a substance in itself, but a privatio boni, a privation of the good. Evil is a lack, a hole in reality where something ought to be. When we apply this to asset management, we see that investing in vice, be it the digital drug of pornography, the predatory mechanics of usury, or the pharmaceutical industrialization of abortion, is literally investing in non-being. It is an allocation of capital toward a void.

From a strictly risk-management perspective, this is terrifying. When you invest in a company whose business model contradicts the Natural Law, you are betting against the structure of reality itself. You are shorting the cosmos. While such a wager may pay off in the short term, just as a building with a cracked foundation may stand for a season, it carries an infinite, hidden tail risk. Vice introduces volatility because vice is inherently unstable. It requires constant escalation to maintain its effect, and it inevitably destroys its host. A customer base addicted to gambling or opioids is a depleting asset, not a growing one. A society that stops reproducing due to anti-life cultural signaling eventually stops consuming, innovating, and growing. The investor holding these assets is holding a ticking time bomb of ontological fragility.

Therefore, the “Integrity Alpha” is not a mystical reward for being a “good person.” It is the superior risk-adjusted return that comes from structural alignment with reality.

We must reject the false dichotomy that frames “Faith-Based Investing” as a form of charity or a concession to piety that accepts lower returns. That is a loser’s mentality. It assumes that the Devil is the better fund manager. It assumes that Reality is structured in such a way that vice is more profitable than virtue. As a realist, I refuse to accept that premise.

The solution is a return to a unified vision of existence. We must seek companies that provide goods and services that genuinely serve the human person, companies that align with human flourishing. This is not about sentimentalism. It is about finding businesses that are “anti-fragile” because they are necessary. A company that feeds families, heals the sick (truly heals, rather than addicting), or builds infrastructure is participating in the “good.” It has a surplus of being. Its customers are not victims to be harvested, but partners in a sustainable cycle of exchange.

When we integrate our portfolios, when we insist that our capital acts in accordance with our conscience, we are repairing the fracture in our own souls. We are becoming whole. We are moving from the chaotic disintegration of the secular marketplace to the stability of the kata-holos.

The fractured portfolio cannot stand because a house divided against itself, metaphysically, morally, and financially, must fall. The prudent steward, the one who truly understands the nature of value, builds his house on the rock of Reality. He knows that in the final accounting, the only wealth that persists is that which served the order of creation rather than its destruction. Let us close the schizophrenia of the Monday morning broker. Let us be whole.