1. Aquinas AI — Your Guide to Understanding the System

An AI companion trained in the Aquinas framework and Report content.

Use it to clarify concepts (equity, prudential bands, operating horizons), deepen your understanding of a signal or model portfolio, or connect current market events to the Aquinas worldview.

It doesn’t design custom portfolios or tell you “what to buy today”; it helps you think with prudence.

2. Type A Signals — Prudential Core Signals

Signals are published only when three filters align: moral suitability (no ontological veto, reasonable justice), sound technical and/or fundamental basis, and prudential coherence.

Each signal includes: the asset or instrument, dominant horizon (H2, H3), a concise thesis, key risks, and indicative entry and partial profit-taking ranges.

Delivered through a private feed and email notifications.

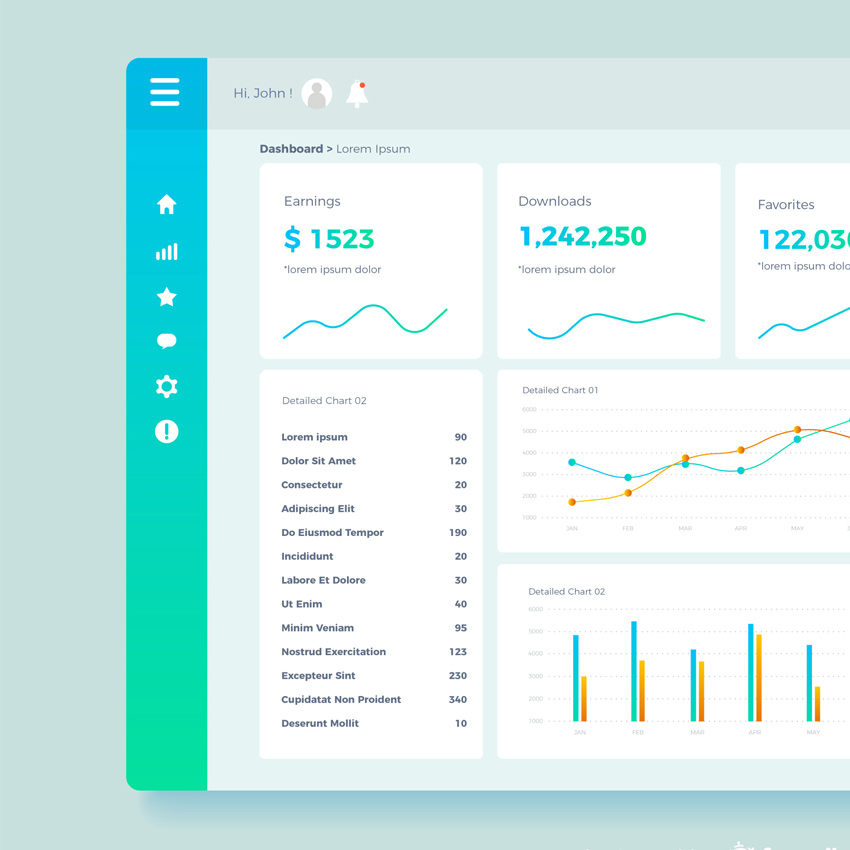

3. Model Portfolios — The Core Allocation Framework

Three base portfolios: Prudent Conservative, Balanced Moderate, and Prudent Growth.

Each includes indicative allocation by asset class, prudential exposure bands (min–max per block), and explicit ethical notes identifying excluded business types.

4. Private Educational Articles

Internal notes explaining how to read signals as an adult investor — not as a gambler — how to use model portfolios without turning them into rigid dogma, and how to integrate prudence, virtue, and data into every decision.

Prudence is not hesitation — it is disciplined clarity in action.