Sine titulo

January 9, 2026 | Aquinas Intelligence | Global Strategy Division

Executive Summary: The Collapse of Nominalism

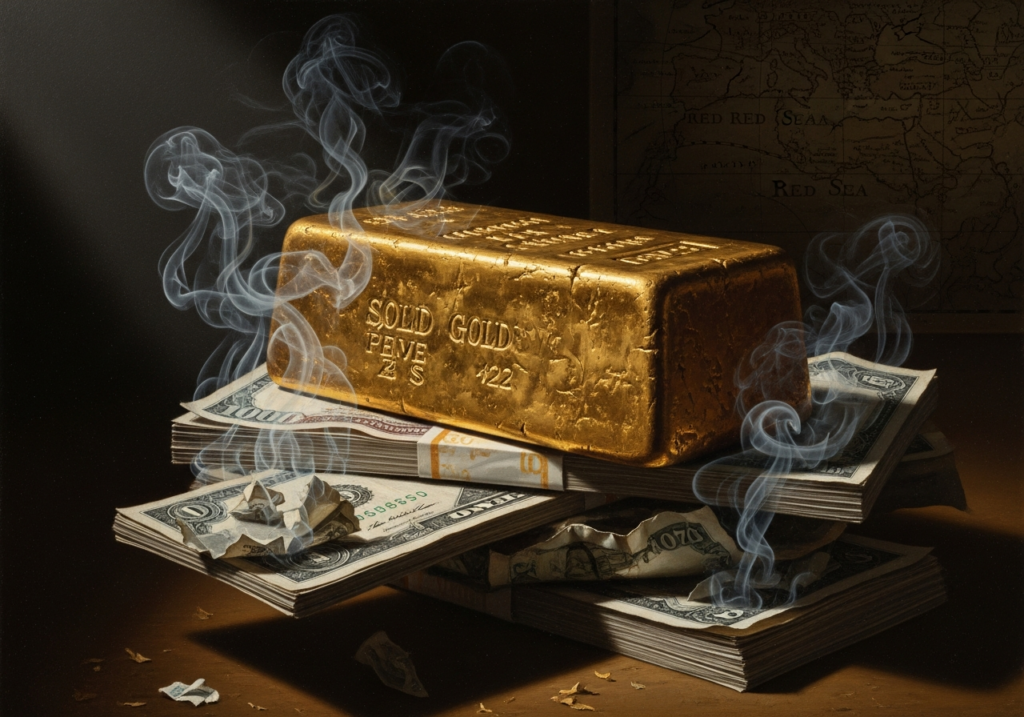

Over the last 72 hours, the global economy has confirmed a fundamental metaphysical shift: the transition from Nominalism (faith in the promise of payment) to Realism (faith in the physical act). While equity markets celebrate “soft landing” narratives, the system architects (Central Banks and Shipping Giants) are executing a strategy of existential defense. The thesis of this report is that structural inflation is not a policy error, but the cost of re-materializing an economy that had forgotten its material causes.

I. Gold and Sovereignty (The Historical Crossover)

Between January 6 and 9, 2026, a data point has crystallized that financial history books will mark as the end of the post-Bretton Woods era. According to cross-referenced sovereign reserve data, the value of foreign central bank gold holdings has exceeded that of their US Treasury holdings for the first time since 1996.

This phenomenon reveals two Aristotelian truths:

- Final Cause (Sovereignty vs. Yield): Buyers like China, Poland, and Brazil are acquiring gold at record prices. Demand has become price inelastic. They are not buying for profit (return), but for immunity (existence). They prefer the pure agere of metal without counterparty risk, over the potentia of debt dependent on political will.

- The Cost of Truth: The fact that Poland (Europe’s bulwark) and China continue to buy relentlessly at these levels indicates that managing elites are discounting a systemic devaluation of fiat promises. They are exchanging “paper” for “matter” before the window closes.

II. The Red Sea: Logistic Fragility

While money seeks refuge in imperishable matter (gold), physical trade struggles with the fragility of matter in motion. As of today, January 9, the situation in the Red Sea has evolved into a dangerous “Fragile Pause”.

Despite technical ceasefires attempted since late 2025, we observe a critical divergence in corporate strategy:

- The Risk Bet (CMA CGM): The French carrier has begun redirecting vessels through the Suez Canal, betting that the truce will hold. They seek efficiency (speed).

- Structural Prudence (Gemini Alliance – Maersk/Hapag-Lloyd): They maintain the long route via the Cape of Good Hope. They prioritize certainty (security).

Economic Implication: We are facing a “Prisoner’s Dilemma”. If peace breaks, transport capacity will contract violently. The “inflation” here is not just of prices, but of friction. The physical world imposes costs that monetary printing cannot subsidize: one cannot “print” a safe passage through the Bab el-Mandeb Strait.

Conclusion: Matter over Form

The “Monetary Illusion” suggests that wealth is a digit on a screen. The “Physical Reality” of January 2026 teaches the opposite: wealth is the possession of unconfiscatable assets (Gold) and the control of secure physical routes.

Verdict: The re-materialization of the economy is inflationary by nature, because matter is finite and scarce, while fiat currency is theoretically infinite. Central Banks know this and are acting accordingly. The prudent investor must watch not what central bankers say, but what their vaults do.